People with diabetes need to be extra cautious about their health. They need to constantly monitor various parameters and visit the doctor’s office for regular check ups. However, going with the original Medicare Plans (Part A and Part B) may not be enough insurance coverage.

Did you know that the average diabetes diagnosis creates medical expenses that are 2.3 times as high as they would be in the absence of diabetes?

For diabetics, enrolling in certain Medicare Advantage plans can offset some of these costs. In this article below, you can learn more about Medicare Advantage Plans that are suitable for diabetics.

Prescription Drugs

Not all Medicare Advantage plans cover prescription drugs. Diabetics need to consider the plans that do. Those plans are known as MAPD (Medicare Advantage Prescription Drugs) plans. A majority of MAPD plans cover insulin, which is significant for diabetics.

Other than insulin, oral medication is included as well. For example, you will be able to receive acarbose that prevents your blood sugar from rising and Alogliptin that increases insulin levels when blood sugars are too high.

Without the appropriate coverage, those meds can be quite expensive, considering that you will use them often. Therefore, Part D can be a nice addition to your healthcare.

Medicare Advantage Plans

As we have already said, the original Medicare doesn’t cover everything. As a diabetic, you may require additional services other than hospital and medical care.

Medicare Advantage Plans are also known as the Medicare Part C can be a great way to fill in the gaps. This works as an alternative to the original Medicare and comes with fixed, but small co-payments for most services and procedures.

With the Medicare Part C, you will receive everything you do from your original Medicare, but the pricing can be a bit different.

This can be a good way for diabetics to ensure that they have fixed co-pays instead of larger expenses on the things the original insurance doesn’t cover.

Insulin and Other Medical Supplies

It is essential for diabetics to select the right plan, especially because of the insulin prices.

“Certain carriers have preferred pricing on insulin. If a patient gets put into the wrong Medicare Advantage Prescription Drug, their insulin could cost them $1000 dollars a month,” according to Katherine Adams, founder of Creative Legacy Group.

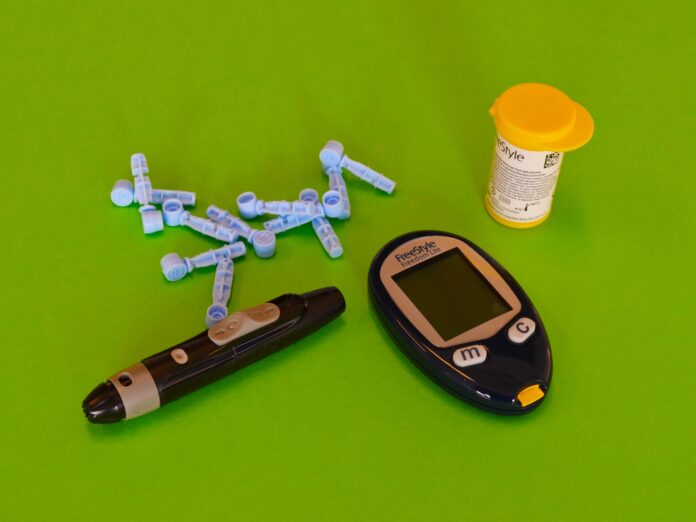

Medicare Advantage also offers durable medical equipment also known as DME. This includes things such as test strips, diabetic shoes, glucose monitors, which are all useful for diabetics.

Speaking of the equipment, diabetic shoes could come in handy. They are designed with soft materials and protective inserts for people with diabetes. Usually, people with diabetes develop conditions such as foot numbness or ulcers and these shoes prove to be helpful.

The bottom line…

Having an original Medicare is crucial for people with diabetes. Choosing the Medicare Advantage Plan could come in very handy because of insulin prices as well as other medical supplies and equipment diabetics need very often. Furthermore, Part D should be considered as it can help with some of the prescription drugs diabetics use.