In the ever-evolving world of trading, the stakes can be astonishingly high. Imagine a scenario where you can refine your strategies, explore new techniques, and enhance your trading acumen—all without risking a dime.

Welcome to the realm of simulated trading strategies, where the thrill of the market meets the safety of a controlled environment. Here, novice traders can familiarize themselves with the intricate dance of market movements, while seasoned professionals can fine-tune their tactics without the pressure of real-world consequences.

This approach allows you a unique opportunity to experiment, learn, and grow, from virtual portfolios to algorithmic simulations. So, how can you harness the power of simulated trading to elevate your performance? Let’s dive in and unveil the secrets to navigating this risk-free landscape, transforming theoretical knowledge into practical prowess.

The Importance of Risk-Free Trading

Setting Up Your Simulated Trading Environment

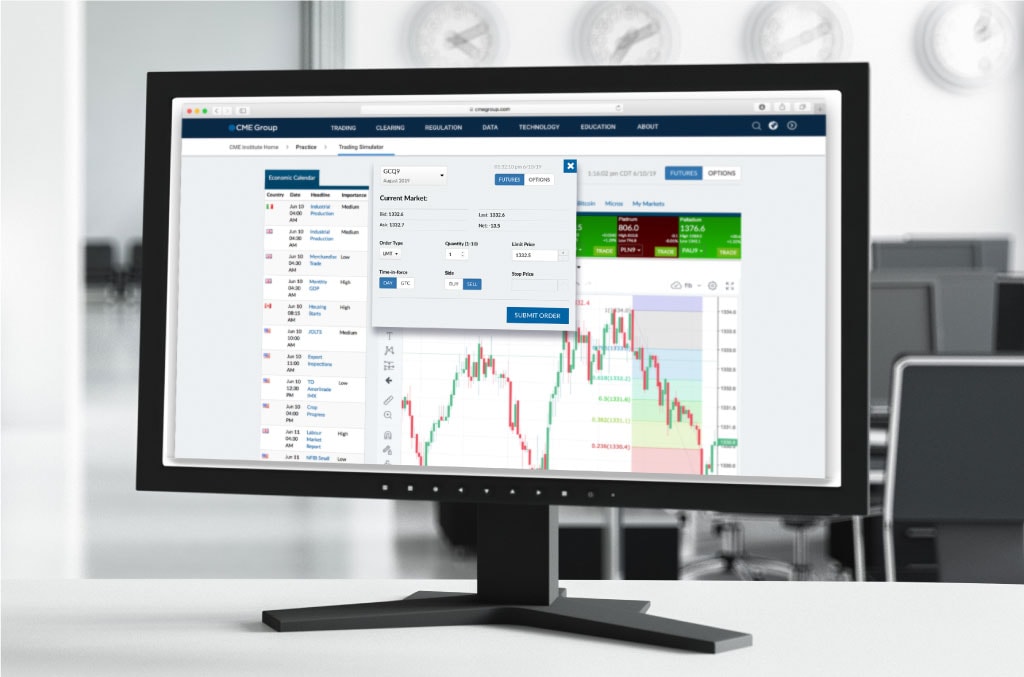

To set up your simulated trading environment, you must create a space that mirrors the realities of the financial markets while allowing for experimentation and learning without the pressures of real money at stake. Begin by selecting a robust trading platform that offers realistic market conditions, complete with live data and a user-friendly interface.

This is your playground, so explore various tools and features—like charting options, technical indicators, and risk management tools—that will enhance your trading strategy. Remember, the goal is to recreate the hustle of trading: engage with a diverse portfolio, test different methods, and track your performance meticulously.

Experiment with timeframes, from day trading to longer-term positions, and reflect on your trades to identify patterns. This is not just about making virtual profits; it’s about building the acumen and confidence necessary to thrive in the fast-paced world of real trading.

As you immerse yourself in this environment, you’ll cultivate a mindset geared toward success, paving the way for your transition to actual trading.

Developing Effective Trading Strategies

Developing effective trading strategies in a simulated environment is a vital step for both novice and seasoned traders aiming to enhance their skills without the burden of financial risk. It begins with comprehensive market research—analyzing patterns, understanding market psychology, and studying historical data.

Armed with this knowledge, traders can experiment with various methodologies: trend following, mean reversion, or even algorithmic approaches that rely on computational power. Each strategy can be tested rigorously through simulations, allowing for adjustments based on performance metrics, which indicate strengths and weaknesses.

Moreover, the iterative process of refining these strategies fosters resilience and adaptability, crucial traits in the ever-changing landscape of trading. As traders engage with different scenarios, they develop not just a toolkit of strategies, but also the confidence to make informed decisions in real markets, paving the way for future success.

Conclusion

In conclusion, simulated trading strategies offer a powerful avenue for traders to enhance their skills and boost performance without the inherent risks associated with real-time trading. By leveraging tools such as a free replay chart, traders can analyze past market movements, test different strategies, and refine their decision-making processes in a risk-free environment.

This approach not only fosters confidence but also equips traders with the knowledge needed to navigate the complexities of live trading. Ultimately, embracing simulated trading as a fundamental component of your trading plan can lead to more informed and strategic decisions, setting the stage for long-term success in the markets.