In the ever-shifting landscape of financial markets, the ability to anticipate future trends has become an invaluable asset for investors and analysts alike. Amidst the chaos of economic fluctuations and unforeseen events, historical data simulations emerge as powerful tools, offering insights that can illuminate the path forward.

By diving deep into past market behaviors, these simulations allow us to unearth patterns that might have otherwise gone unnoticed. They work like a time machine, enabling us to adjust variables and envision potential future scenarios based on the rich tapestry of historical performance.

As we explore the intricate dance of data versus time, we find that the lessons of yesterday can empower us to navigate the uncertainties of tomorrow, transforming raw numbers into a robust narrative of potential market movements. In this article, we will delve into the methodologies behind historical data simulations and examine how they are revolutionizing the way we predict and respond to market trends.

The Role of Historical Data in Market Predictions

Historical data serves as an invaluable beacon in the tumultuous sea of market predictions, illuminating trends that may otherwise go unnoticed. By delving into past performance metrics, analysts can identify patterns—anomalies, spikes, or dips—that provide crucial insights into market behavior.

Consider how a recession in the early 2000s impacted various sectors; the lessons gleaned from such historical fluctuations can be transformative for predictive modeling. Moreover, integrating diverse datasets—from stock prices to economic indicators—allows for a multifaceted understanding of market dynamics, enriching the tapestry of analysis.

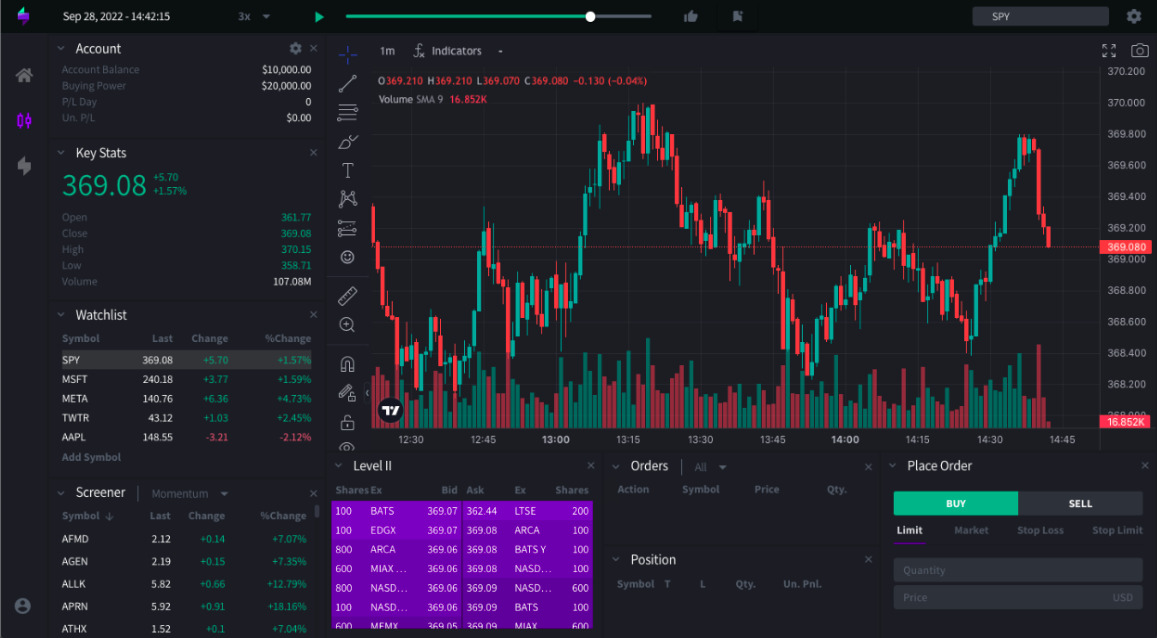

Utilizing tools like a free replay chart tool can further enhance this process, enabling analysts to simulate past market conditions and test predictive models without financial risk. This complex interplay of data layers not only enhances the accuracy of forecasts but also equips investors and strategists with the foresight necessary to navigate the unpredictable currents of the financial landscape.

In this way, historical data does more than just reflect the past; it becomes a vital tool for envisioning the future.

Tools and Technologies for Data Simulation

In the realm of data simulation, a plethora of tools and technologies exist to empower analysts and researchers in their quest to unearth meaningful market insights. From sophisticated software like MATLAB and R, which allow for intricate modeling and statistical analysis, to user-friendly platforms such as Tableau and Power BI that visualize historical trends with dazzling clarity, the options are abundant.

For those who seek the raw power of programming, Python libraries like NumPy and Pandas provide robust frameworks for data manipulation and simulation. Meanwhile, cloud-based solutions like AWS and Google Cloud offer the scalability needed to handle vast datasets without breaking a sweat.

By harnessing these technologies, practitioners can not only simulate past data but also generate predictive models that illuminate potential future scenarios, making the complex dance of market behavior a bit more decipherable. The fusion of these tools creates a landscape where both simple and complex analyses can coexist, allowing for deeper insights into the ever-evolving tapestry of market dynamics.

Best Practices for Effective Market Trend Predictions

To effectively predict market trends utilizing historical data simulations, its essential to adopt a multi-faceted approach that encompasses diverse analytical techniques and an acute awareness of varying market dynamics. Begin by meticulously collecting a robust set of historical data, ensuring it reflects a wide range of market conditions, including booms, recessions, and unexpected events.

Employ advanced statistical methods, such as time series analysis or machine learning algorithms, to unearth hidden patterns and correlations that may not be immediately apparent. However, don’t stop there; context is key.

Regularly integrate qualitative insights from industry experts or emerging news that might influence market behavior. Remain agile, ready to adjust your predictive models in response to new data or shifting economic landscapes.

Lastly, always validate your predictions against real-time outcomes, allowing for continuous refinement of your methods. In this way, you harness the power of historical data to not just forecast trends, but to anticipate them with greater accuracy and confidence.

Conclusion

In conclusion, leveraging historical data simulations is a powerful way to enhance your understanding of market trends and make informed predictions about future movements. By analyzing past performance and market behaviors, traders and analysts can identify patterns that could shape investment strategies and decision-making processes.

Tools like a free replay chart tool further empower users to practice and refine their skills, allowing them to visualize and interact with historical data in real-time. This integration of technology and historical analysis not only boosts confidence but also equips market participants with the insights they need to navigate the complexities of the trading landscape.

Ultimately, embracing these methodologies can lead to more strategic investments and a deeper grasp of market dynamics.