Investing in high-dividend yield companies can be a lucrative strategy for those looking to grow their wealth through the stock market. By focusing on companies that consistently pay out a significant portion of their earnings to shareholders in the form of dividends, investors can potentially generate a steady stream of passive income over time.

However, finding the right high-dividend yield companies to invest in requires careful research and analysis. In this article, we will explore the steps investors can take to identify and evaluate promising high-dividend yield companies, as well as the key factors to consider before making investment decisions.

By following these steps, investors can build a diversified portfolio of high-quality dividend-paying stocks that can help them achieve their financial goals.

Researching High-Dividend Yield Companies

Researching high-dividend yield companies requires a strategic approach to identifying stable and profitable companies that consistently pay dividends to shareholders. Investors should begin by conducting thorough industry research to identify sectors that typically offer high dividend yields, such as utilities, real estate investment trusts, and consumer staples.

Next, investors should analyze the financial health and stability of potential high-dividend yield companies by reviewing key metrics such as earnings growth, cash flow, and debt levels. Additionally, investors should consider the company\’s dividend history and payout ratio to determine if the dividend is sustainable in the long term.

By taking a comprehensive approach to researching high dividend stocks, investors can make informed decisions to build a profitable dividend portfolio.

Analyzing Dividend History and Growth Potential

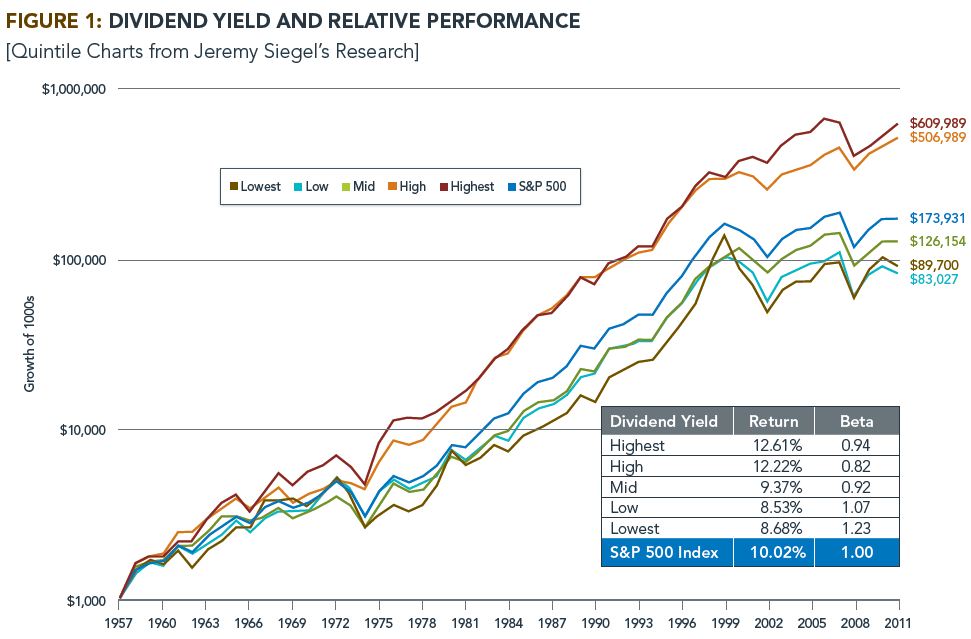

In order to make informed investment decisions when it comes to high-dividend yield companies, analyzing dividend history and growth potential is crucial. By looking at a company’s past dividend payouts and how they have evolved over time, investors can get a sense of the company’s reliability and commitment to rewarding shareholders.

Additionally, evaluating the growth potential of dividends is essential in determining the likelihood of future increases, which can lead to higher returns on investment. By carefully examining these factors, investors can choose companies with strong dividend track records and promising growth prospects, ultimately maximizing their investment outcomes.

Evaluating Company Financials and Market Performance

When it comes to evaluating company financials and market performance in order to invest in high-dividend yield companies, there are a few key factors to consider. First and foremost, analyze the company’s balance sheet to assess its financial health and stability.

Look for companies with strong cash flow, manageable debt levels, and consistent earnings growth. Next, delve into the income statement to understand the company’s revenue streams and profitability.

A company with a proven track record of increasing dividends over time is a good indicator of financial strength. Additionally, research the market performance of the company by analyzing its stock price trends, market capitalization, and overall performance compared to industry peers.

By thoroughly evaluating these factors, investors can make well-informed decisions when it comes to investing in high-dividend yield companies.

Conclusion

In conclusion, investing in high-dividend yield companies can be a lucrative strategy for those looking to generate steady income from their investments. By following the steps outlined in this article, investors can identify and evaluate high dividend stocks that have the potential to provide strong returns over time.

It is important to conduct thorough research, diversify your portfolio, and continuously monitor the performance of your investments to maximize your returns and mitigate risks. With careful planning and patience, high-dividend yield companies can play a valuable role in building a successful long-term investment strategy.